Employers and executives in New Jersey say they are pessimistic about the outlook for the coming year, with the state still not doing enough to address affordability and the cost of doing business.

The New Jersey Chamber of Commerce and Industry’s 64th annual outlook report released Monday said 75 percent of employers believe the Democrats in power have done nothing to make the Garden State more affordable, even with its high tax revenues.

Just 5 percent of the 468 respondents said New Jersey leaders, including the governor, are doing enough. Phil Murphy and the legislative leader, both Democrats.

Some 46 percent of businesses said the state could not afford it somewhat, and 36 percent said it couldn’t afford it at all, according to the survey.

Most said they were concerned about inflation, rising costs and external economic pressures, and planned only modest growth in the year ahead. Many worry about the regulatory burden next year and difficulties finding staff.

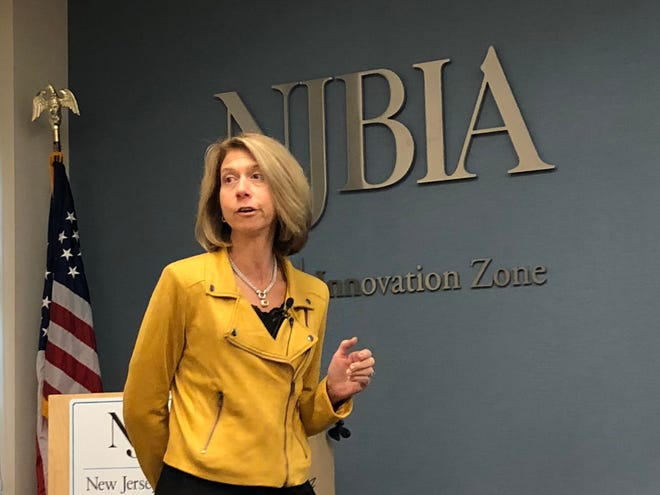

“It was a year of historic spending and a budget surplus without comprehensive business relief – and our businesses have taken note,” the association’s president, Michele Siekerka, said in a statement accompanying the study.

Murphy has been touting his administration’s progress on affordability for months, since he narrowly missed his re-election bid last fall.

The recent credit upgrade is seen as evidence that his policy of overhauling the country’s fiscal institutions has paid dividends. Murphy spokeswoman Christy Pease said the state has provided $850 million in loans, grants and other emergency support to more than 80,000 employers during the pandemic.

Peace said there is funding for manufacturers and Main Street restoration programs, as well as minority businesses.

“The Governor understands the challenges facing our business community and values the views of business owners on how the state can help them grow and prosper,” Pease said. “As our state continues to recover from the impact of the COVID-19 pandemic, The government will continue to work with business leaders to find solutions to the challenges facing this community.”

But Siekerka is critical of a $2 billion ANCHOR property tax break for homeowners and renters because it excludes businesses. She also warned that businesses would still need a $1 billion tax increase to replenish unemployment trust funds depleted by the pandemic.

“It sends a strong message to businesses that they don’t have the support they need in Trenton,” she said.

When it comes to taxes and fees, 83 percent of respondents said the state was worse than other states, while 74 percent said New Jersey was worse at reining in government spending, such as the record $50.6 billion state budget.

The report found that 65 percent of respondents were heavily impacted by increased supply and material costs, and 63 percent by increased fuel costs. Twenty-nine percent of respondents said they would have to lay off workers in the next year to account for inflation, while 35 percent said they would not and 36 percent said they were not sure.

“Clearly, the war in Ukraine, international economic struggles and inflation in the United States will require us to do more in New Jersey,” Senate Budget Chairman Paul Sarlo, D-Bergen, said in a statement.

He and House Speaker Craig Coughlin (D-Middlesex) suggested Tuesday that they might eliminate the top business surcharge next year, rather than extending it indefinitely as a source of revenue for the state.